Title Loans, Payday Loans, Loan Sharks.

If you annualized the interest rate on a title loan, it could be as high as 300%. If you annualized the interest rate on a payday loan, it could be as high as 459%. So why do people risk their future fiscal health by utilizing these financial tools?

Desperation. Hopelessness. No way out.

I’ve never taken out one of these loans, but early on in my life as a small business owner, I’ve run up a credit card balance or made a withdrawal from my IRA just to meet living expenses. It seemed like the only option at the time. I vividly remember one of these episodes. I had a great client (who is still a client and now a good friend) who asked me to clear my calendar because he was signing on a new customer and would need my help servicing this customer and it was all but a done deal. It was going to be a long engagement worth at least $100K (at that point, the largest engagement I had ever landed). He was still in shock when he called to tell me the job he knew was already in the bag went to one of his competitors. I thanked him for thinking of me, then hung up the phone wondering what I was going to do. I’d let my pipeline run empty because I wouldn’t have had the bandwidth to service any additional clients. There was no work and replenishing the pipeline was going to take a while. And, yes, I’m aware I broke about a dozen rules that I advise my clients to live by, but at the time it seemed to make sense.

I’m aware that situation is mild compared to the binds that others have found themselves in. Some have faced losing a house. Others have been confronted with the realization that a loved one couldn’t get much-needed medical treatment. Some have seen the enterprise they founded crashing to the ground. Certainly a blow to the ego and many times representing the loss of personal wealth and the investment of others who trusted the founder to not only return their money but to return it with a sizable gain. The common denominator in desperation is the immediacy of the consequences. If the foreclosure is a year from now, we think we can turn it around. But, if the foreclosure is three days away, the desperation is in full bloom.

So why don’t we get help before we’re desperate? Business leaders bet big on themselves. They believe they’re creating something that will change their customers lives for the better. And they believe they’ll succeed – that’s why they started in the first place. A lot of times, asking for help seems like a tacit admission of failure.

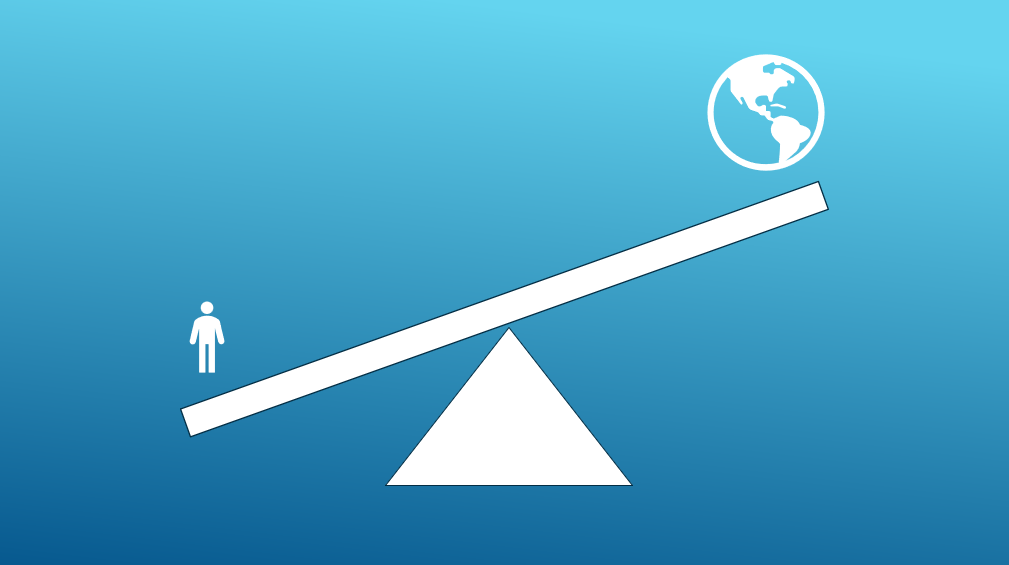

When we let ourselves get to the point of desperation, we settle for stop-gap solutions, half-baked solutions, lesser solutions, and excessively expensive solutions. We don’t have time to research. We don’t have time to ponder.

As a fellow business owner, let me offer a change of perspective. We look at getting help like we look at going to the doctor – there’s something wrong that needs to be healed. In reality, getting help is more like an elite athlete getting a coach. Just like a world-class athlete, you’re already in rarified air – you’re a business owner or business leader. When an athlete gets a coach, we think nothing of it. In fact, we expect it. They hire coaches to push them farther, to strengthen an already strong game. Business leaders should do the same.

Desperation is a tyrant. Borrowing expertise is a hedge against it.